KID REPORTERS’ NOTEBOOK

Record Inflation Worries Consumers

Jose Marquin of Redwood City, California, told Munveer that he has seen the cost of food and gas skyrocket.

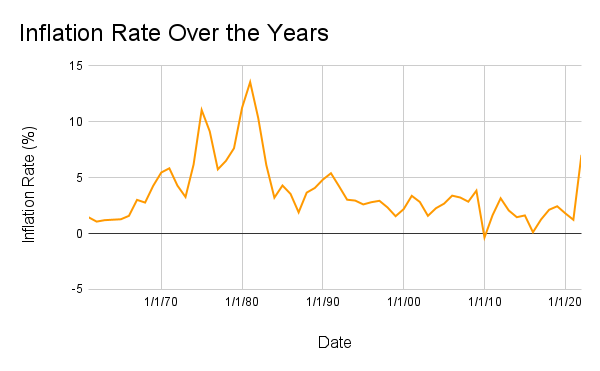

In 2021, the inflation rate in the United States climbed 7%. It was the highest jump in almost 40 years. Inflation is the overall increase in the price of goods and services. Due to inflation, the buying power of the dollar goes down every year. For example, $10 may have gotten you five candy bars last year, but will only get you three this year.

Due to rising prices, people in the U.S. are paying more for necessities. “I have to pay $50 dollars more for groceries a week,” says Jose Marquin of Redwood City, California. “It’s unbelievable how much prices have gone up. I’m paying almost $80 for a full tank of gas, when I used to pay $50.”

Prices are affected by fluctuations in supply and demand. Supply is the amount of a product that is available, and demand is the amount of people who want it. If supply is less than demand, prices can go up. If supply is higher than demand, prices go down.

The Federal Reserve [Fed], the central banking system in the U.S., aims for inflation to rise between 1 and 2% per year. It doesn’t always meet its target. With people spending much more than they did at the beginning of the coronavirus pandemic, prices have been steadily increasing. The inflation rate is now at 7.5%.

“There is a higher demand, which is being driven by stimulus programs and low interest rates,” says Brian Marks, a Lecturer of Economics at the University of New Haven, Connecticut. “On the supply side, the COVID-19 public health crisis impacted the entire supply chain for goods throughout the world.”

The inflation rate is now at 7.5%.

THE GOVERNMENT’S ROLE

An increase of money in circulation and decreased supply are causing the inflation rate to rise. Should the government intervene? Some people say no, arguing that previous government interventions hurt the economy. But many economists and consumers are looking for the government to manage inflation.

“The Federal Reserve is expected to increase interest rates, which reduces demand,” Marks said. “Similarly, government policy can address the supply shortage by formulating programs that can ease supply chain pressures.”

The Fed has met several times in the past few months to discuss how to control rising inflation rates. After a meeting in January, Chairman Jerome Powell said, “It’s our job to get inflation down to 2%.”

President Joseph R. Biden will be addressing the issue, too, in his State of the Union address on March 1. Anxious consumers are hoping that he and the Fed will succeed in controlling the cost of living.